We operate as an independent multi-family

company with clients’ interest at heart which goes...

MON 4 MAR

•The second session of China’s CPPCC will begin, a day before the start of China’s National People’s Congress.

•Earnings: Celltrion, China Tower.

TUE 5 MAR

•China’s National People’s Congress will begin.

•The Caixin PMI survey will be released in China.

•In Japan Tokyo inflation data will be out. BoJ Governor Ueda will be speaking.

•Earnings: Target.

•US election: Super Tuesday primaries will be held in North Carolina, California and Texas & other states.

WED 6 MAR

•Earnings: JD.

•In the US, mortgage applications, ADP employment (150K) and job openings data will be out.

•Fed Chair Powell will be speaking before the House Financial Committee.

THU 7 MAR

•FX reserve # will be reported by China. Malaysia’s Central Bank is expected to keep rates on hold.

•Earnings: MTR, Techtronic, Wharf REIT.

•The ECB is expected to keep rates on hold. ECB President Lagarde will speak after the meeting.

•Fed Chair Powell be appearing before the Senate Banking Committee.

•Biden will be delivering his State of the Union address, his final one before the US election in Nov.

•The open on Friday will be marked by the expiry of the key March Nikkei options.

•Markets in India will be closed for a holiday.

•In the US nonfarm payrolls are expected to show a continued increase (200K) with the unemployment rate expected to remain unchanged (3.7%).

•Earnings: Oracle, Costco and ZTE.

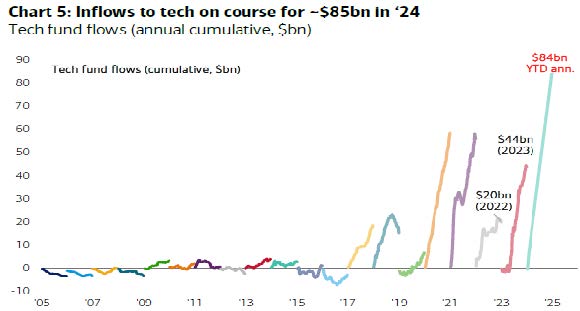

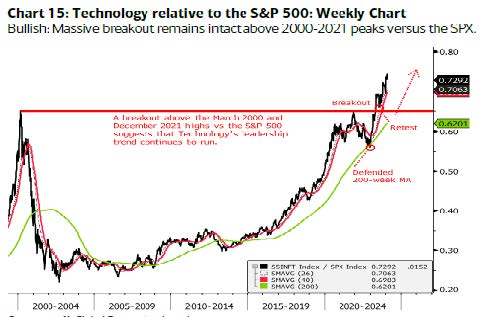

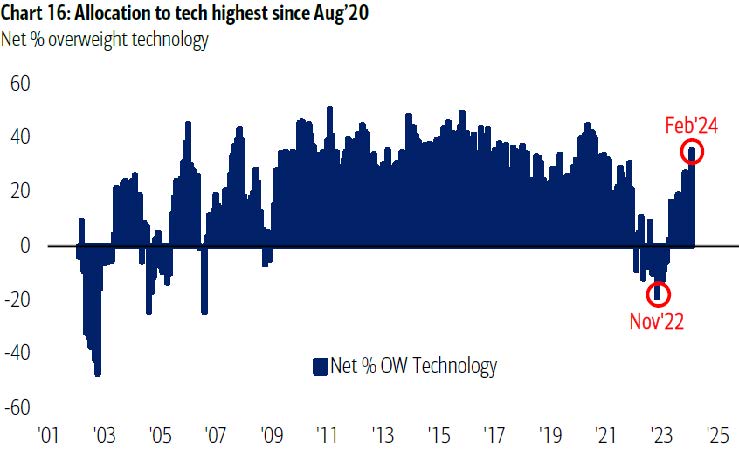

TECH EARNINGS

Now that Nvidia's results are in, here's what we know:

(source:Bloomberg)

Disclaimer

This document is issued by JMC Capital Asset Management Singapore Pte. Ltd.(“JMCAM”) solely for personal reference. This material is purely for informational and reference purposes only with no consideration given to the specific investment objective, financial situation and particular needs of any specific person. It should not be relied upon as financial advice.

We are not making an offer, solicit to sell any security or product with you through this document. Nothing in this document shall be deemed as an offer or solicitation to sell any security or product or to enter into any transaction with you.

No representation or warranty whatsoever in respect of any information provided herein is given by us and it should not be relied upon as such. We do not undertake an obligation to update the information or to correct any inaccuracy that may become apparent at a later time.

All information presented is subject to change without notice. We shall not be responsible or liable for any loss or damage whatsoever arising directly or indirectly howsoever in connection with or as a result of any person acting on any information provided herein.

The information contained herein may not be copied, reproduced or redistributed without the express written consent of JMCAM. While reasonable care has been taken to ensure the accuracy of the information as at the date of publication, JMCAM does not give any warranty or representation and disclaims any form of liability for any errors or omissions. Any opinions or predictions as at the date of the material may be subject to change without notice.

JMCAM accepts no liability for any loss, direct or indirect or consequential damages, arising from any use of or reliance on this document and the information contained herein. This document has not been reviewed by nor approved by the Monetary Authority of Singapore.