We operate as an independent multi-family

company with clients’ interest at heart which goes...

MON 25 MAR

•Markets in India will be closed for a holiday.

•Earnings: Petrochina, China Merchants Bank, China Resources Land.

•US New Home Sales (market expectation 675k)

TUE 26 MAR

•In China the Baoaforum will begin and continue until Friday.

•Earnings: BYD, NongfuSprings, CiticSecurities, PICC, Anta Sports and Mengniu Dairy.

•In the US, the Philly Fed, durable goods orders, house prices and the Richmond Fed index will be released.

•Earnings: ICBC, China Life, Midea, Bocom, China Everbright Bank, Chalco.

•US mortgage applications are expected to fall.

THU 28 MAR

•Earnings: Agricultural Bank, Bank of China, China Construction Bank, Postal Savings Bank, China Pacific Insurance, COLI, Minsheng Bank, Air China, Country Garden and Vanke.

•US Q4 GDP data (market expectation 1.6%) will be reported along with PCE data (expecting 2.1%), personal consumption, jobless claims, PMI and Michigan sentiment.

FRI 29 MAR

•Markets in Australia, Hong Kong, India, Indonesia, Philippines, Singapore, US, UK and Germany will be closed for holidays.

•Earnings: Industrial Bank, SAIC and Shanghai Port.

•In the US personal income (expecting 0.4%) and spending (expecting 0.5%) will be reported.

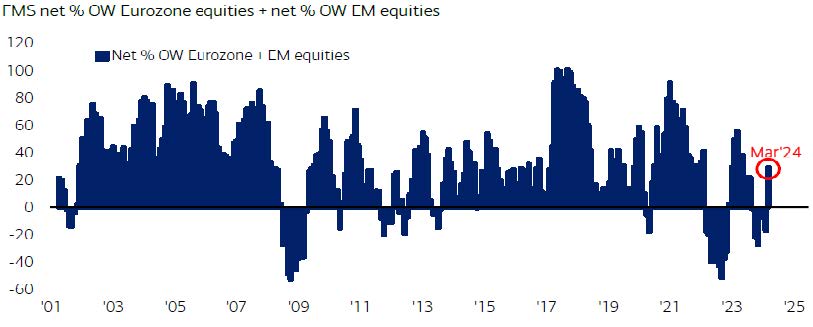

• March saw a big MoM rotation into EM stocks (largest jump since Apr 2017) and into Eurozone stocks (largest jump since June 2020).

• Allocation to Eurozone and EM equities combined is the highest since May 2023.

EM

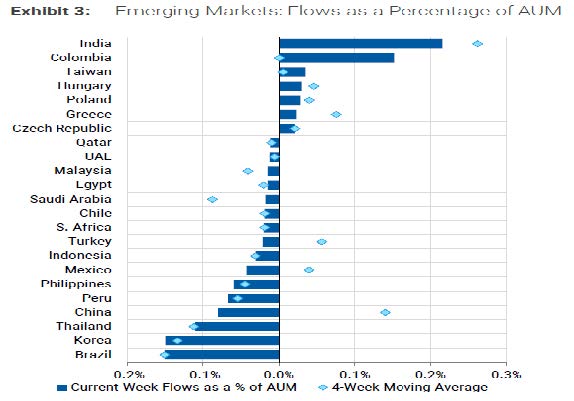

Relative to AUM, India, Colombia, and Taiwan recorded the largest inflows within EM, while Brazil, South Korea, and Thailand recorded the largest outflows.

AI SEMI SUPPLY CHAIN

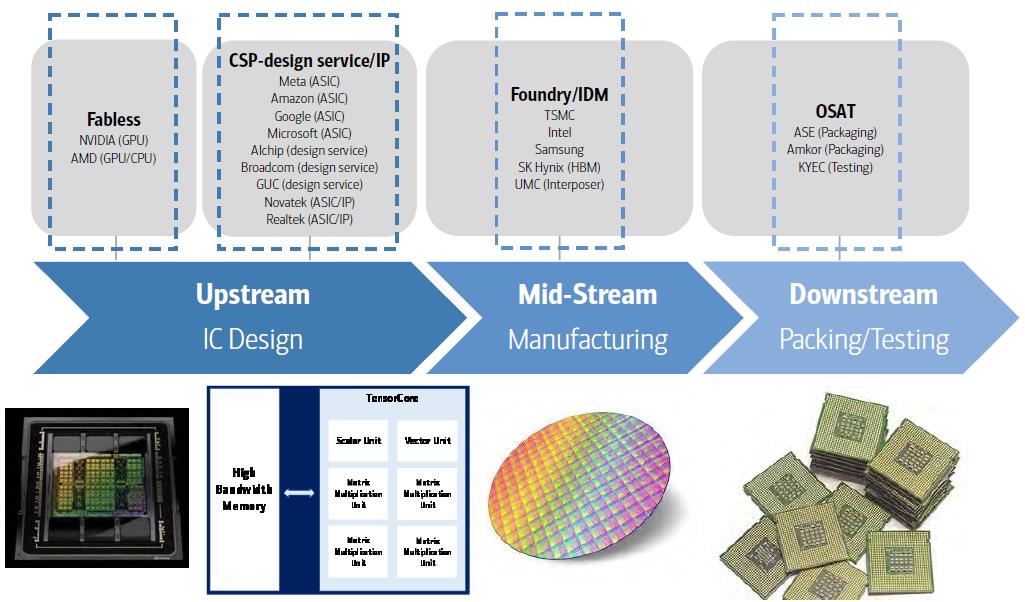

Taiwan plays a key role in design service, foundry, and OSAT for AI server semis currently.

(source:Bloomberg)

Disclaimer

This document is issued by JMC Capital Asset Management Singapore Pte. Ltd.(“JMCAM”) solely for personal reference. This material is purely for informational and reference purposes only with no consideration given to the specific investment objective, financial situation and particular needs of any specific person. It should not be relied upon as financial advice.

We are not making an offer, solicit to sell any security or product with you through this document. Nothing in this document shall be deemed as an offer or solicitation to sell any security or product or to enter into any transaction with you.

No representation or warranty whatsoever in respect of any information provided herein is given by us and it should not be relied upon as such. We do not undertake an obligation to update the information or to correct any inaccuracy that may become apparent at a later time.

All information presented is subject to change without notice. We shall not be responsible or liable for any loss or damage whatsoever arising directly or indirectly howsoever in connection with or as a result of any person acting on any information provided herein.

The information contained herein may not be copied, reproduced or redistributed without the express written consent of JMCAM. While reasonable care has been taken to ensure the accuracy of the information as at the date of publication, JMCAM does not give any warranty or representation and disclaims any form of liability for any errors or omissions. Any opinions or predictions as at the date of the material may be subject to change without notice.

JMCAM accepts no liability for any loss, direct or indirect or consequential damages, arising from any use of or reliance on this document and the information contained herein. This document has not been reviewed by nor approved by the Monetary Authority of Singapore.