We operate as an independent multi-family

company with clients’ interest at heart which goes...

MON 8 APR

•US Treasury Secretary Yellen will be meeting with PBOC Governor Pan before holding a press conference at the conclusion of her visit to China.

•In the US the NY Fed will release 1yr inflation expectations.

TUE 9 APR

•Hong Kong FX reserves data will be out.

•China is expected to report new loans, money supply and aggregate financing data.

WED 10 APR

•The US is expected to report an acceleration in CPI although the pace of rises in core prices is expected to have dropped. US hourly earnings will also be reported.

•Overnight the minutes from the 21 Mar Fed meeting will be released.

•South Korea will be holding elections for the National Assembly.

•The Reserve Bank of New Zealand and Bank of Thailand are expected to keep rates on hold.

THU 11 APR

•China will report CPI and PPI data.

•The ECB is expected to keep rates on hold at its meeting and ECB President Lagarde is expected to hold a press conference after the meeting.

•In the US PPI and initial jobless claims data will be reported.

FRI 12 APR

•Bank of Korea is expected to keep rates on hold at 3.50%.

•In the US, earnings season is expected to start with JPMorgan, Wells Fargo, Blackrock and Citigroup reporting.

MACRO OUTLOOK

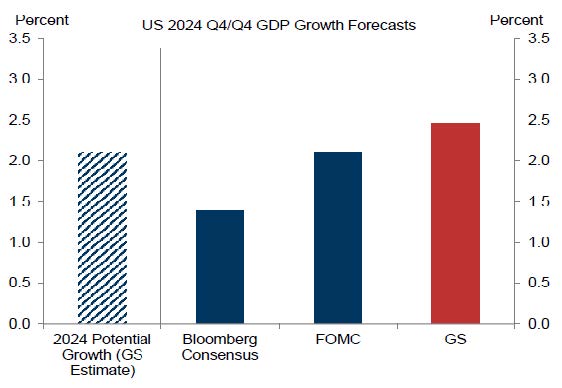

The macro outlookfor the rest of 2024 remains friendly. The US economy should continue to grow nicely above trend, picking up speed as the year moves along, with three rates cuts along the way.

REFLATON

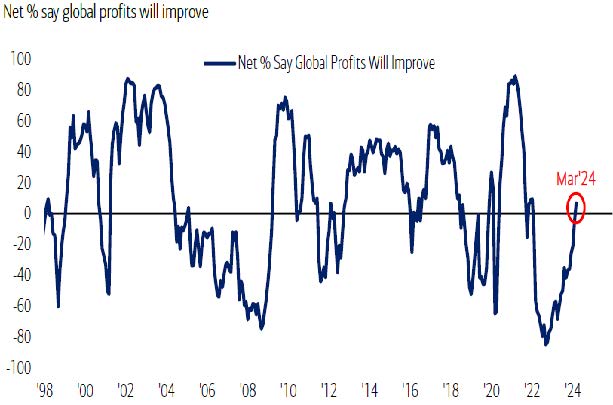

Looking at recent price action in commodities and cyclical stocks, there’s a fairly clearpattern of reflation playing through. While market focus in recent months has often centered around the downside risks, following stronger than expected macro data, I found myself wondering if we should be asking the opposite question: how should we invest if economic growth is higher not lower from here?

TECH EARNINGS

The market expectation is pretty highfor TECH stocks, particularly given the fact that mega cap tech blew the doors off the field in the Q3 and Q4 reporting periods. We suspect they will display less upside convexity in the coming earnings season.

INFLATION

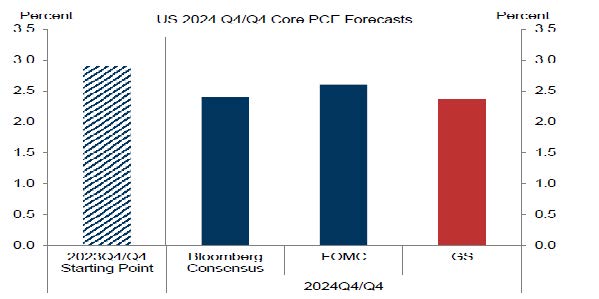

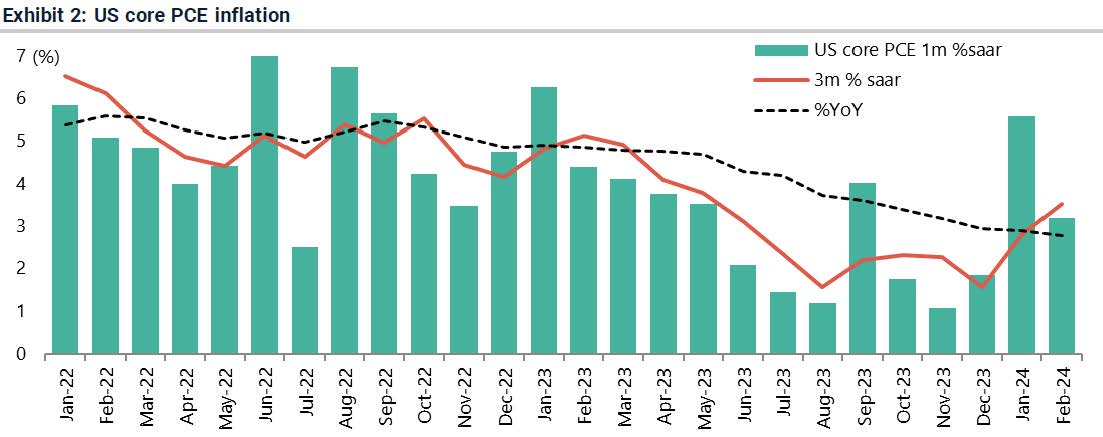

•The market clearly underestimated the resilience of inflation.

•Core CPI was still up 3.8% YoY in Feb and, perhaps more interestingly, up 4.2% on a three-month annualized basis. This is still way above Fed’s 2% target.

(source:Bloomberg)

Disclaimer

This document is issued by JMC Capital Asset Management Singapore Pte. Ltd.(“JMCAM”) solely for personal reference. This material is purely for informational and reference purposes only with no consideration given to the specific investment objective, financial situation and particular needs of any specific person. It should not be relied upon as financial advice.

We are not making an offer, solicit to sell any security or product with you through this document. Nothing in this document shall be deemed as an offer or solicitation to sell any security or product or to enter into any transaction with you.

No representation or warranty whatsoever in respect of any information provided herein is given by us and it should not be relied upon as such. We do not undertake an obligation to update the information or to correct any inaccuracy that may become apparent at a later time.

All information presented is subject to change without notice. We shall not be responsible or liable for any loss or damage whatsoever arising directly or indirectly howsoever in connection with or as a result of any person acting on any information provided herein.

The information contained herein may not be copied, reproduced or redistributed without the express written consent of JMCAM. While reasonable care has been taken to ensure the accuracy of the information as at the date of publication, JMCAM does not give any warranty or representation and disclaims any form of liability for any errors or omissions. Any opinions or predictions as at the date of the material may be subject to change without notice.

JMCAM accepts no liability for any loss, direct or indirect or consequential damages, arising from any use of or reliance on this document and the information contained herein. This document has not been reviewed by nor approved by the Monetary Authority of Singapore.