We operate as an independent multi-family

company with clients’ interest at heart which goes...

MON 15 APR

•Earnings: CATL, Goldman Sachs.

•China is expected to keep its 1yr medium term lending facility unchanged at 2.50%.

•In the US retail sales, Empire Manufacturing and housing market data will be reported.

•In the US, the payment of federal income taxes is due.

TUE 16 APR

•Earnings: Bank of America, Morgan Stanley and Johnson&Johnson.

•China will report house price data, industrial production, GDP, retail sales and unemployment figures.

•Baidu will be holding its AI developer conference in Shenzhen.

•German Chancellor Scholz will be holding talks with President Xi in Beijing.

WED 17 APR

•Earnings: ASML and Abbott Labs.

•G7 foreign ministers will be meeting in Capri, Italy.

THU 18 APR

•Earnings : TSMC, Infosys, Bajaj Auto, Poscoand Blackstone.

•Overnight the Fed will be releasing its Beige Book of economic activity.

•In the US the Philly Fed index will be reported along with initial jobless claims.

FRI 19 APR

•Earnings: China Tower, P&G, Netflix and American Express.

•Japan will be reporting inflation figures.

VIX

- 3 months vs 1 month volatility as a tactical sentiment indicator, stocks are oversold below 1, stocks are over-bought above 1.25. Currently 1.05, approaching buy level.

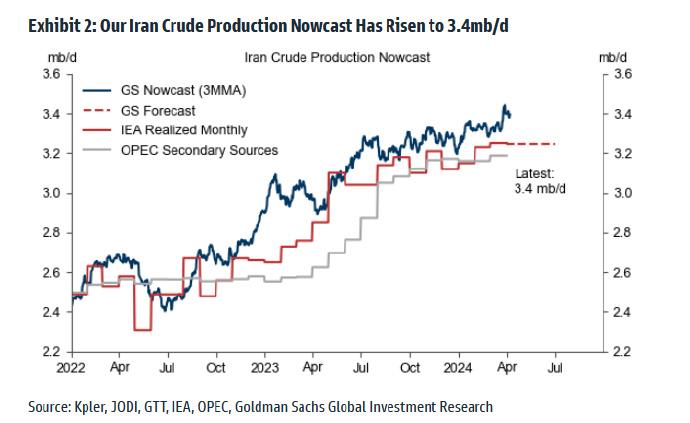

IRAN

Iran crude production remains stable.

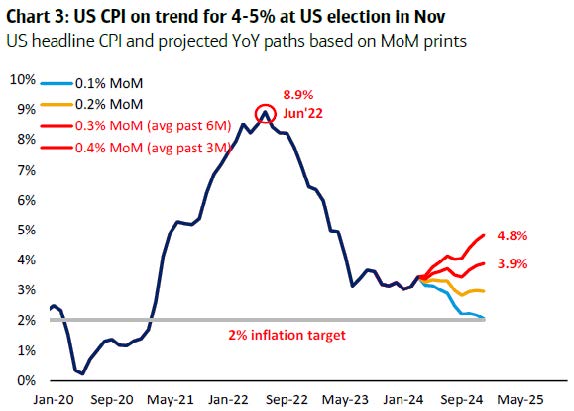

US INFLATION

US CPI on course to be 4-5% by Nov US election.

(source:Bloomberg)

Disclaimer

This document is issued by JMC Capital Asset Management Singapore Pte. Ltd.(“JMCAM”) solely for personal reference. This material is purely for informational and reference purposes only with no consideration given to the specific investment objective, financial situation and particular needs of any specific person. It should not be relied upon as financial advice.

We are not making an offer, solicit to sell any security or product with you through this document. Nothing in this document shall be deemed as an offer or solicitation to sell any security or product or to enter into any transaction with you.

No representation or warranty whatsoever in respect of any information provided herein is given by us and it should not be relied upon as such. We do not undertake an obligation to update the information or to correct any inaccuracy that may become apparent at a later time.

All information presented is subject to change without notice. We shall not be responsible or liable for any loss or damage whatsoever arising directly or indirectly howsoever in connection with or as a result of any person acting on any information provided herein.

The information contained herein may not be copied, reproduced or redistributed without the express written consent of JMCAM. While reasonable care has been taken to ensure the accuracy of the information as at the date of publication, JMCAM does not give any warranty or representation and disclaims any form of liability for any errors or omissions. Any opinions or predictions as at the date of the material may be subject to change without notice.

JMCAM accepts no liability for any loss, direct or indirect or consequential damages, arising from any use of or reliance on this document and the information contained herein. This document has not been reviewed by nor approved by the Monetary Authority of Singapore.